الحار منتجات

ملكنا الإخبارية

flotation costs-What is floatation cost

Flotation Costs Overview, Factors, and Cost of Capital

2022年12月28日 The flotation costs for the issuance of common shares typically ranges from 2% to 8%. Flotation Costs and Cost of Capital. The concept of flotation costs is

Flotation Costs Overview, Factors, and Cost of Capital

1 Flotation costs, expected return on equity, dividend payments, and the percentage of earnings retained are all factors in calculating a company's cost of new equity.When a

Flotation Costs Corporate Finance CFA Level 1

2019年9月12日 When flotation costs are specified as a percentage applied against the price per share, the cost of external equity is represented by the following equation: re = (

Flotation Cost: Meaning, Example, And Why is Relevant for

Why Flotation Cost is Relevant for the Firms? At the time of issuance of equity share, the floatation cost is paid in cash form. These costs are incorporated into the projects of firms

Flotation Cost in Project Evaluation Calculation, Example

2022年6月11日 WACC = 11.15% when the flotation cost is part of the cost of capital. When flotation cost is part of cost of capital, NPV = 117057 100000 = 17057. Additional Cash

Flotation Costs Definition How to Calculate Examples

2021年3月6日 The flotation costs increased the cost of the new equity issuance by 0.7%. Many analysts consider this approach inappropriate. This is because flotation costs are

How Flotation Costs Affect Cost Of Capital? FAQS Clear

2022年5月29日 Flotation costs are costs a company incurs when it issues new stock. Flotation costs make new equity cost more than existing equity. Analysts argue that

Cost of Preferred Stock with Flotation Costs Nifty Tutors

2021年8月10日 The Cost of Equity and Flotation Costs Suppose a company will issue new 25-year debt with a par value of $1,000 and a coupon rate of 8%, paid annually. The tax

How do you calculate flotation cost? IronSet

2021年5月5日 How do you calculate flotation cost? The difference between the cost of new equity and the cost of existing equity is the flotation cost, which is (20.7-20.0%) = 0.7%.

Flotation Costs and the Weighted Average Cost of Capital

The weighted average cost of capital (K o) is presented in virtually all textbooks in financial management and capital budgeting as a practical concept fundamental to the actual selection of optimal financial and investment alternatives.As often employed K o can be defined as. where. K o = the weighted average cost of capital,. K s = the cost of equity

Flotation Cost- 金融百科 金融知识

2013年2月5日 Flotation Cost. 英文名称:Flotation Cost 中文名称:发行成本. "指发行新证券的成本,包括承销费用、聘请会计师、律师的费用等。. e.g. While those reports were being finalized, exploration drilling of the G-9 deposit continued to delineate high-grade zones of zinc mineralization which were amenable to lower

Flotation Costs Definition How to Calculate Examples

2021年3月6日 The flotation costs increased the cost of the new equity issuance by 0.7%. Many analysts consider this approach inappropriate. This is because flotation costs are actually a cash outflow at the beginning of the project. Instead, this method adjusts the PV of future cash flows by a fixed percentage. So, the later stages of the project are

Flotation Costs and WACC Finance Train

Flotation cost is generally less for debt and preferred issues, and most analysts ignore it while calculating the cost of capital. However, the flotation cost can be substantial for issue of common stock, and can go as high as 6-8%. In the investment industry, there are different views about whether flotation costs should be incorporated in the

How to Calculate Flotation Costs Sapling

2019年6月12日 The cost of equity calculation before adjusting for flotation costs is: re = (D1 / P0) + g, where "r e " represents the cost of equity, "D 1 " represents dividends per share after 1 year, "P 0 " represents the current share price and "g" represents the growth rate of dividends. The cost of equity calculation after adjusting for flotation costs

How Flotation Costs Affect Cost Of Capital? FAQS Clear

2022年5月29日 Flotation costs are costs a company incurs when it issues new stock. Flotation costs make new equity cost more than existing equity. Analysts argue that flotation costs are a one-time expense that should be adjusted out of future cash flows in order to not overstate the cost of capital forever.

Cost of Debt in WACC Formula Equation Examples

where P is the current market price of a bond, N is the number of years to maturity, and C is the annual coupon payment. If a company performs a new bond issue, it can face flotation costs. In that case, the formula above must be modified as.

What is meant by floatation cost ? Find 11 Answers

2015年11月9日 Flotation costs are paid by the company that issues the new securities and includes expenses such as underwriting fees, legal fees and registration fees. Companies must consider the impact these fees will have on how much capital they can raise from a

How do you calculate flotation cost? IronSet

2021年5月5日 How do you calculate the cost of preferred stock with floatation cost? Solution: Fixed dividend = $60 x 6% = $3.eeds = Market price Floatation costs = $70 (5% of $70) = $66.5 Cost of preferred stock (r ps ) = Fixed dividend/Net proceeds = $3.6/$66.5 = 5.41% r ps = 5.41% 9-5 Cost of Equity DCF: Summerdahl Resort’s common

Cost of Capital Final COST OF CAPITAL COST OF

The costs of floatation amount to Rs. 30,000. The debentures are redeemable after 5 year Calculate before-tax and after tax cost of debt assuming a tax rate of 50%. Ans. 6% Q9 5-years Rs. 100 debentures of a firm can be sold for a net price of Rs. Equity shares Rs 2 per share flotation costs,sale price Rs 22 In addition the dividend

Flotation Costs and the Weighted Average Cost of Capital

The weighted average cost of capital (K o) is presented in virtually all textbooks in financial management and capital budgeting as a practical concept fundamental to the actual selection of optimal financial and investment alternatives.As often employed K o can be defined as. where. K o = the weighted average cost of capital,. K s = the cost of equity

Floatation cost definition — AccountingTools

2022年10月21日 Floatation cost is the expenditure incurred when issuing new securities. Floatation cost can be quite high as a proportion of the total proceeds from the sale of securities when the proceeds are not expected to be that large. Consequently, issuers have an incentive to issue more securities than are actually necessary, thereby lowering the

Flotation Costs Definition How to Calculate Examples

2021年3月6日 The flotation costs increased the cost of the new equity issuance by 0.7%. Many analysts consider this approach inappropriate. This is because flotation costs are actually a cash outflow at the beginning of the project. Instead, this method adjusts the PV of future cash flows by a fixed percentage. So, the later stages of the project are

Flotation Costs and How to Correctly Reflect Them in

2019年4月18日 Cost of preferred stock with flotation costs can be worked out using the following formula: Cost of Preferred Stock =. D. P 0 × (1 F) Where P 0 is the current price of a share of preferred stock, F is the flotation cost as percentage of issue price P 0 and D is the annual preferred dividend. Flotation cost-adjusted yield on debt can also be

Flotation Mineral ProcessingMetallurgy

2016年1月11日 FLOTATION COST. The oil-mixtures generally in use will cost from 1.25c. up to 3c. per lb. depending on the proportion of cresol and other high- priced oils used, but 1½c. per lb. will be a safe average on

Floatation Costs and Investment Banking Management

2023年2月28日 However, floatation costs also affect the return on investment. For example, if the company generates $10.5 million from the utilization of $100 million funds, it cannot claim a 10.5% return. This is because the gross amount raised is $105 million. The floatation costs also need to be taken into account, and this reduces the return on equity

What is meant by floatation cost ? Find 11 Answers

2015年11月9日 Flotation costs are paid by the company that issues the new securities and includes expenses such as underwriting fees, legal fees and registration fees. Companies must consider the impact these fees will have on how much capital they can raise from a

How do you calculate flotation cost? IronSet

2021年5月5日 How do you calculate the cost of preferred stock with floatation cost? Solution: Fixed dividend = $60 x 6% = $3.eeds = Market price Floatation costs = $70 (5% of $70) = $66.5 Cost of preferred stock (r ps ) = Fixed dividend/Net proceeds = $3.6/$66.5 = 5.41% r ps = 5.41% 9-5 Cost of Equity DCF: Summerdahl Resort’s common

Cost of Preferred Stock with Flotation Costs Nifty Tutors

2021年8月10日 The Cost of Equity and Flotation Costs Suppose a company will issue new 25-year debt with a par value of $1,000 and a coupon rate of 8%, paid annually. The tax rate is 40%. If the flotation cost is 3% of the issue proceeds, then what is the after-tax cost of debt? Disregard the tax shield from the amortization of flotation costs.

المصنعين 300tph كسارة في الهند-قرض للهند كسارة الحجر

hammer gold ore ws

بيع معدات الاستحسان الساخنة

العتيقة عجلة بيلتون 36

line crusher tire-machine is for crushing tyre

ball mineral procedures

chammer mill ore to 300 microns

فن آوری شن و ماسه

krupp mining material handling

crushing machine used by electro pneumatic

مصنع آلات التعدين غاندونغ

Guangzhou putty powder processing plant

حزام ناقل للخدمة الشاقة لاستخدام منجم الحجر

gold ore separator gold

how to get gypsum mines in oman

خط إنتاج التكسير بالطحن الجاف

الفحم الألغام في مصر

شركة صنع معدات ثقيلة

وحدة تصنيع الرمل الصغيرة في مصر

ماكينات أسود الكربون المنشط

iti turner fitter machinist grinder driller

grinding clinker technology

تخطيط السعة والمخططات الانسيابية للتخطيط الكلي

Magnetic Separator Order

جهاز كشف الاثار الفرعونية المصرية

风力发电机组设备-风力发电机组设计

حول لدينا

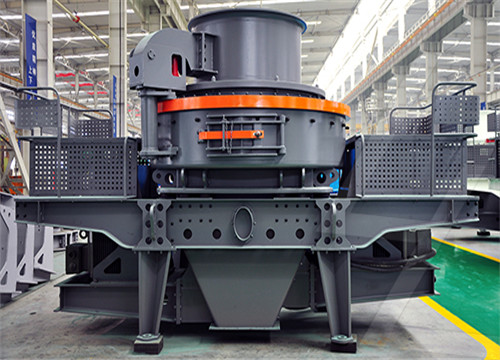

تأسست شركة Henan Lrate للعلوم والتكنولوجيا المحدودة التي تصنع معدات التكسير والطحن الكبيرة والمتوسطة الحجم في عام 1987. وهي شركة مساهمة حديثة مع البحث والتصنيع والمبيعات معًا.

على مدار أكثر من 30 عامًا ، تلتزم شركتنا بنظام الإدارة العلمية الحديث والتصنيع الدقيق والريادة والابتكار. الآن أصبحت LIMING رائدة في صناعة تصنيع الآلات المحلية والخارجية.

2021/07/20

2021/07/20